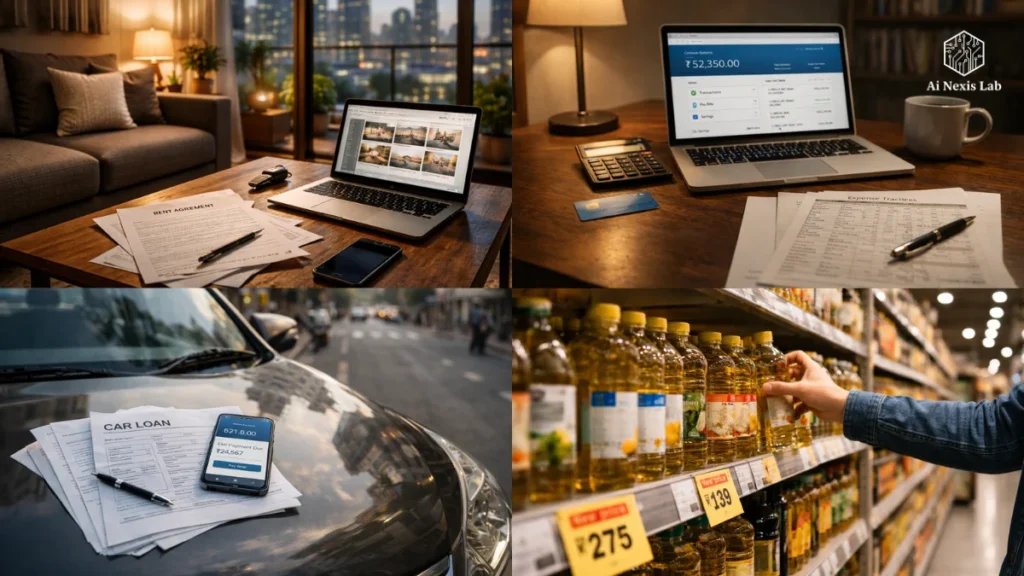

Buy Now, Pay Never? How to Reduce Your Living Expenses in 2026 (Real-World Game)

Learn how to cut your cost of living in 2026 with proven strategies, real savings tips, and actionable systems that keep money in your pocket – start saving today.

Let’s be clear: you can’t outrun the economy by “hacking” it with tricks. If you want to reduce your living expenses in a way that actually works in 2026, you need a framework based on real financial mechanics – interest, fees, inflation, behavior, and systems you control. Not vague “loopholes.”

Inflation is not going away – and in many regions it is above pre-pandemic levels, squeezing household budgets and plunging people into debt. In the UK, for example, inflation is still outpacing savings returns and the household savings ratio has fallen sharply, meaning many people are living paycheck-to-paycheck with little buffer.

So let’s break this down into solid, no-nonsense strategies that really move the needle.

1) The truth about “Buy Now, Pay Later” (BNPL) – and what works instead

BNPL did not become a permanent shortcut to financial freedom. He became the accelerator of debt.

Here’s what the data says:

What BNPL really is:

- Short-term debt where you get something now and pay off the installments later.

- It is commonly marketed as “interest-free,” but the fees and behavioral costs are real.

- Surveys show that most users have overspent, missed payments, or regretted purchases.

Why it hurts your finances:

- Small monthly payments may seem psychologically cheaper, but they increase your fixed monthly obligations, reducing flexibility.

- Late fees and penalties are real costs – and when you skip micro-payments, credit scores take a hit.

- Many BNPL systems are not truly interest-free; They just hide cost structures that hurt you in the long run.

Real Strategy: The “Save Now, Pay Later” Discipline

Your idea of “save now, pay later” is conceptually sound – but let’s make it a premise.

Instead of borrowing to spend, force yourself to build a cash reserve for every major purchase. Here’s how:

a) Use high-yielding savings instead of low-interest bank accounts.

Many traditional banks pay around 0% to 0.5% on savings, which is below inflation – meaning your money loses value while sitting there. In contrast, high-yielding online savings accounts or fixed deposits can pay 4-6% or more, which at least combats inflation.

You don’t earn a “hack discount” – you just don’t lose value.

b) Forced commitment:

Set aside cash, especially for planned large purchases (equipment, furniture, travel).

When you only spend what you’ve already saved, purchasing decisions become deliberate – not impulsive.

c) If you are already in debt:

Stop adding to it. Then attack with a methodical strategy – pay off the highest expense balances first. This is standard debt reduction behavior, not a trick.

2) Grocery Costs – No More Guesswork

Food inflation is real. People often waste money because they buy reactively and throw away food. Here’s what really works:

AI and apps are tools – not magic

Apps that predict price drops or track inventory can help you plan – but they’re not a substitute for real budgeting.

Most importantly:

Track past spending so you know what you’re really eating and when.

Build meals around what you already have in your pantry.

Don’t buy a “bargain” if you won’t use it.

Zero-waste planning

Most households waste hundreds of dollars each year simply by letting food go to waste. That’s not inflation – that’s stupid planning. Take inventory of your fridge, freezer, pantry – then plan meals using what’s there before buying more.

Bulk buying only works if:

- You really need the stuff.

- You have storage.

- The wholesale price per unit is really low.

If you throw away things you bought in bulk, you’re losing money, not saving it.

3) Banking Fees – Cut the Parasites

Banks make money from fees and low interest spreads – whether it’s maintenance fees, ATM fees, forex mark-ups, or reinstatement fees for overdrafts.

Here’s what to do:

a) Audit your account

If you’re paying anything more than a zero maintenance fee, you’re losing money.

Consider switching to neo-banks or credit unions that have zero fees and reimburse ATM costs. This is a straightforward, evidence-backed way to keep more of your cash.

b) Forex and International Transactions

When you travel or shop online abroad, always choose to be charged in the local currency – otherwise banks apply a 3-5% conversion markup.

c) Use virtual cards for subscriptions

Set a low or zero balance on the virtual card used for the trial so that automatic renewal fails. This prevents “ghost subscriptions” – recurring small expenses that many people forget about.

But don’t rely on gimmicks. The only reason for this is that companies test charges against available funds – if you tightly control cash flow, you control subscriptions.

4) Income and Spending Discipline: What Works in 2026

Right now (according to 2025-2026 data), household savings rates are falling and many people are saving less than 10% of their income – not because they don’t want to, but because they haven’t organized their financial structure.

You need a system:

a) Budget like a business

Stop the “hope budget”. Track every penny that comes in and goes out. Use a spreadsheet or app that lets you categorize:

- Fixed expenses (rent, utilities)

- Variable expenses (groceries, fuel)

- Irregular expenses (car service, medical, travel)

Knowing exactly where your money goes can change behavior overnight.

b) Emergency Fund First

Set aside 3-6 months of essential living expenses in a liquid, high-interest bucket. This is not optional – it prevents you from borrowing when life confronts inevitable surprises.

c) Automation beats motivation

Set up automatic transfers to:

- Savings accounts

- Investment accounts

- Bills

Treat savings like a non-negotiable bill that you pay yourself.

5) Investments and inflation protection

This is not a “cheap life hack” – it’s basic wealth preservation.

Inflation erodes purchasing power. If your savings earn less than inflation, your real wealth shrinks. It has been proven time and again by central bank data globally.

Best Moves in 2026

- High-yield savings and short-term fixed deposits

- Inflation-protected investments (where available)

- Diversified portfolio – bonds + equities + real assets

- Retirement accounts with tax benefits

There’s no heckling around compound interest – it’s the only force that beats inflation over the long term.

6) Housing: The Silent Budget Killer

If your housing costs are wrong, no amount of late-skipping will save you. Housing remains the single biggest expense for most households in 2026 – and also the area where people lie to themselves the most.

Many buyers still stretch for the “maximum loan they qualify for.” It’s not a financial ambition. That is financial self-sabotage.

Reality Check Rule

If your rent or mortgage is more than 30-35% of your take-home pay, you are running a fragile system. One job interruption, one medical event, one family crisis – and debt becomes inevitable.

Banks approve loans based on their profit model – not on what keeps your life stable. Stop trusting approvals as validation. They will happily let you have more time.

2026 Housing Optimization Strategy

- If renting: Negotiate renewals early. Landlords prefer stable tenants to the risk of vacancy.

- If possessive: Avoid emotional upgrades. A larger home increases taxes, maintenance, utilities, and furniture costs – not just the mortgage.

- If relocating for work: Compare not just the salary increase, but the total cost of living. A 20% salary increase in a high-cost city can still reduce your net savings.

Housing is not about status. It’s about controlling your biggest fixed costs. Anyone who ignores this is playing the wrong game.

7) Transportation: The Car Payment Trap

In 2026, average car payments in many countries are at historic highs. And yet cars are depreciating assets – guaranteed loss machines.

If you are financing a car for more than 4-5 years, you are not taking “ownership” of it. You are renting it from the bank with interest.

Transport Value Rule

If the vehicle loses value faster than you are paying for it, you are underwater by design.

Smart 2026 Transportation Choices

- Buy used, not new. The first 2-3 years of depreciation are brutal.

- Avoid long auto-loan periods. Low EMIs seem convenient – but multiply the total interest.

- Factor in insurance, fuel, servicing, parking – not just the sticker price.

Owning a car should be a mobility solution. It shouldn’t become your second rental payment.

8) The Time-Payment Problem: Small Expenses That Really Matter

People obsess over “big purchases” but spend money every day through frictionless expenses:

- Food delivery

- Ride-hailing

- Micro-subscriptions

- Convenience store markups

Everyone seems to be in a disadvantage. Together, they quietly consume 10-20% of disposable income.

Friction Principle

Simple costs increase equipment costs.

Difficult spending tools reduce spending.

That’s why:

- Stored card details

- One-tap payment

- Auto-renewal

…always works in the seller’s favor, not yours.

Counter-Move

- Remove saved cards from shopping apps.

- Require manual login for purchases.

- Use a separate “spending wallet” account with a limited balance.

Reduce spending a little. Your bank balance will thank you.

9) The Psychology of “Feeling Poor” Even When You’re Not

Here’s an uncomfortable truth:

Many people aren’t broke.

They’re just disorganized.

Money comes in. Money goes out. No structure. No clarity. No system. Then panic.

A simple system outperforms higher incomes every time.

3-Bucket System

- Fixed Expense Bucket – Rent, Utilities, Insurance

- Daily Expense Bucket – Food, Transportation, Entertainment

- Wealth Bucket – Savings, Investments, Emergency Fund

Automate income distribution into these the day the money comes in.

No willpower required. No guesswork. No chaos.

Most financial stress is not about income level.

It’s about the lack of structure.

10) Why Most “Money Hacks” Fail

Let’s get this straight.

People like hacks because hacks seem easier than discipline.

But:

- Cashback cards don’t help if you overspend.

- BNPL does not help if you buy unnecessary things.

- Bulk deals don’t help if you waste food.

- If you keep services you don’t need, negotiation apps don’t help.

The key skill is decision-making ability, not tools.

Tools enhance behavior. They don’t change it.

11) The Only Real “Buy Now, Pay Never” Strategy

Here’s the real formula – no marketing spin:

- Spend less than you earn.

- Save before you spend.

- Avoid interest on depreciating items.

- Invest surpluses consistently.

- Keep fixed costs low.

- Maintain an emergency buffer.

Do this for 24-36 months and your financial stress will decrease dramatically.

Ignore it and no app, AI, or loophole will save you.

The Ultimate Reality Check

Cutting your living expenses in 2026 isn’t about extreme frugality.

It’s about:

- Forced debt elimination

- Controlling fixed costs

- Automatic savings

- Frictionless cost reduction

- Thinking in systems, not impulse

That’s it. No magic. No secret tricks. Just financial physics.

Real 2026 Value-Finding Toolkit

Here’s a simple toolkit that actually works, based on real data and basic financial mechanics.

| Strategy | What Actually Works |

|---|---|

| Big Purchases | Save first, never borrow for depreciating items |

| Debt | Prioritize paying down high costs first |

| Savings | Use high-yield accounts above inflation |

| Budgeting | Track every expense, automate savings |

| Fees | Eliminate all bank and subscription fees |

| Grocery spend | Plan, inventory, buy only what you use |

| Inflation | Invest in inflation-resistant assets |

This isn’t sexy – but skipping tricks like “secret loopholes” and focusing on discipline saves real money.

Frequently Asked Questions

Q: Is BNPL ever a good deal?

A: Only if you already have cash set aside and you are using BNPL to intentionally delay payment without fees. But most people use it to spend more than they can afford – which is why surveys show overspending and credit problems.

Q: What is a high-yield savings account and why is it important in 2026?

A: A high-yield savings account pays significantly more interest than traditional banks – sometimes 4-6% or more. Traditional banks often pay out close to zero, which means your money loses purchasing power due to inflation. The high yield helps preserve value.

Q: How much should I save monthly in 2026?

A: There is no set number for everyone, but here is a sensible baseline:

1) Emergency fund: 3-6 months of living expenses

2) Savings rate: 20% of income if possible (varies by income stability)

Data shows that many families save below this – and that is why financial stress persists.

Q: Are grocery apps and AI price predictions worth using?

A: They help you plan, but they’re not luck-based hacks that magically reduce costs. Real savings come from planning ahead, reducing waste, and buying only what you need.

Q: Will automated negotiation apps really reduce my bills?

A: Sometimes. They can help you get better rates on utilities or subscriptions. But the real savings come from cutting out unnecessary services and negotiating from a position of knowledge – without relying on AI to do it for you.