Michael Dell’s $6.25 Billion “Trump Accounts” Gift: What It Means for 25 Million U.S. Kids?

Michael Dell and Susan Dell are reshaping American opportunity with their historic $6.25B donation to seed 25 million new “Trump Accounts.” We unpack the revolutionary child savings plan, analyze the intergenerational wealth transfer, and explain who benefits.

This was the kind of news that stops you in your tracks. Not just big news, but monumental, culture-changing news. On December 2, 2025, headlines broke: Michael Dell and Susan Dell were pledging a staggering $6.25 billion to establish what they called “Trump Accounts” for 25 million children in the United States.

Six pounds two five billion. Let that number marinate for a second. It’s not just a large sum of money; It is a dizzying, head-spinning vortex of capital aimed at leveling the playing field for the next generation. We are talking about a philanthropic act that is so bold, so comprehensive, that it goes beyond even a simple donation. It is a systemic effort to rewire the financial DNA of American youth.

I’m still honestly trying to process the scale.

For years, we have talked, debated, and wrangled over the yawning wealth gap. We have seen generation after generation how luck – the ‘birth lottery’, as some call it crudely – determines a child’s future prospects more than their talent or hard work. Now, one of tech’s giants, the man who built a PC empire from a college dorm room, steps in with a sledgehammer. He’s not just giving money; He is sowing the seeds of access to capital in the lives of a quarter of the country’s children.

This is not about charity, not in the traditional, temporary-fixed sense. This is about creating an entirely new economic foundation for millions of families who need a head start that isn’t miles behind what they already are.

But what exactly are these Michael Dell Trump accounts? Why the name? And can a massive philanthropic effort really address decades of systemic inequality? Let’s unpack this financial giant and see what makes it tick. Because trust me, this is much more complicated than just a headline – and much more interesting.

The announcement that shook the charitable world

This announcement fell like a planet in a calm lake of high-level philanthropy. Long an important, but often low-level donor, Dell suddenly positioned himself alongside giants like Gates and Bezos, but with a focus: early, broad, and democratized capital.

The size of this fund – $6.25 billion – is enough to make you blink twice. It is set to provide an initial investment seed for 25 million children, specifically targeted at newborns and young children, ensuring that the funds last as long as possible for growth. What is the goal? Turning a small initial investment into a meaningful amount by the time the child reaches adulthood.

The Mechanics: What exactly are these “Trump accounts”?

Let’s clarify the name first. The media, particularly USA Today and CNBC, quickly began using the name “Trump Accounts” in their initial reports. The term seems like a slightly political, but catchy, acronym for a specific type of Child Development Account (CDA) or Baby Bond concept that has gained policy traction in recent years, often supported by policymakers seeking wealth redistribution methods. It’s a policy idea, not a partisan endorsement – although the name certainly gives it a charged edge.

In practical terms, Dell’s contribution looks like this:

- Initial Seed Investment: This donation will be designed to provide a basic investment for eligible children, possibly managed by a non-profit foundation or public-private partnership.

- Targeted allocation: Obviously, the focus is not on the richest children. It is designed to target low- and moderate-income families, likely using federal poverty guidelines or eligibility for programs like Medicaid or SNAP as a benchmark.

- Restricted use: This is not pocket money. The funds are typically locked up until the child turns 18, 21, or 25, and can only be used for wealth-building purposes: higher education, job training, starting a business, or a down payment for a home. This restriction is important; It ensures that money becomes capital, not just consumption.

- Matching incentives: One of the brightest parts of the plan, as hinted at in the initial analyst briefing, is the inclusion of future matching incentives. For every dollar a family saves in the account (up to a modest limit), the fund can match a portion, effectively teaching financial discipline and maximizing growth potential.

This is not just about giving cash. It’s about creating a tax-advantaged, professionally managed fund that benefits from the miracle of compound interest – the closest thing to magic in the financial sector – for more than two decades.

Tectonic shifts in American wealth creation

Think about the standard story of the American dream. It usually starts with hard work, perhaps a small loan, and a lot of dedication. It’s romantic, sure, but it ignores the cold, harsh reality: capital begets capital. When you start a race 100 feet behind the line, willpower alone won’t cut it.

That initial amount, even if it’s “only” a few thousand dollars on the first day, acts as a financial anchor. It changes the perspective of the child and the parent.

The psychology of starting early

Imagine there are two 10-year-old children. A child grows up knowing that college is a vague, terrifying debt monster. The second child knows he has a dedicated, growing account because of the Dell initiative. Conversation “Can we afford college?” to “Which college can this money help me get into?” changes in.

That mental shift – from scarcity to possibility – is the most valuable part of giving. It is the creation of cognitive bandwidth that is not consumed by the anxiety of lack. It plants the simple, powerful idea that I have wealth. I own capital. From what I’ve seen, an ownership mindset changes the way a teenager approaches school and job choices.

Beyond the Simple Savings Account: The Investment Thesis

To develop the $6 billion into a generational opportunity, the fund will not invest in T-bills. It should be managed professionally, possibly diversifying into index funds. Dells aren’t just giving money; They are providing access to the efficient, high-growth machinery of the modern financial market. This democratizes sophisticated investing.

Little Leo’s Story: A Real-World Scenario

Let’s imagine a child whose life is completely changed by this initiative.

Meet Little Leo. He was born in 2026 in Milwaukee to a single mother who worked two service jobs. College, or even used car ownership, seems like an unfamiliar concept in their home.

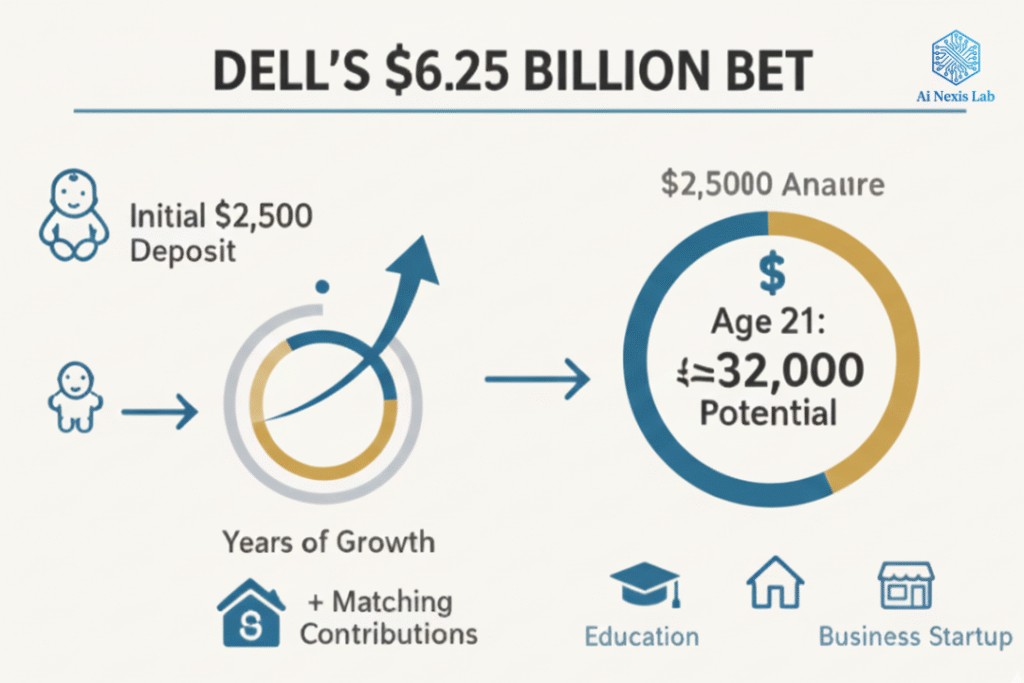

Year 0 (2026): Leo is born. His mother registers him with a simple checkbox at the local health clinic. $2,500 is deposited into Leo’s Michael Dell Trump account – which is invested in a diversified S&P 500 index fund.

Year 10 (2036): The initial $2,500 has, conservatively, grown to $6,000. Leo’s mother, encouraged by a small matching incentive, manages to save $50 per month for two years. The account balance is now $8,500. Leo sees this number on his school’s financial literacy screen. College is not a dream; It is a number.

Year 18 (2044): Leo graduates from high school. Assuming a conservative 7% annual return over 18 years, the total balance in his restricted-use account is $22,000.

Leo is not getting a four-year university degree. He has experience with complex machinery and is pursuing an advanced professional trade program – Robotics Maintenance – which costs $15,000. He uses $15,000 from his account, gets certified, and immediately lands a high-paying manufacturing job.

He escaped predatory student debt. He received high-value training. He still has $7,000 left for a future down payment. This is the point. It is a ladder out of the cycle of uncertain, low wealth.

What most people misunderstand about generational accounts

The immediate reaction is often cynical: “The rich are just throwing away the pieces,” or “That’s not enough for college.”

Most people get this fundamentally wrong: they confuse a donation with an immediate payment.

This is not a bank account, this is a growth fund.

The savings account is passive. This initiative from Dell is an active investment vehicle designed for maximum, long-term growth. When people see the initial deposit number – maybe $2,500 – they scoff. But that initial capital, thanks to 18 to 25 years of compound growth, becomes a truly meaningful amount.

Let’s look at the statistics again.

| Initial Deposit (2026) | Annual Growth Rate (Conservative) | Final Value at Age 21 (2047) |

|---|---|---|

| $2,500 | 7% | ≈ $10,240 |

| $2,500 + $25/month family contribution | 7% | ≈ $32,000 |

Even with minimal contributions from parents, the initial seed becomes a five-figure fortune. With modest, incentive contributions, that’s enough to cover significant trade school expenses or a powerful down payment. There is a difference between taking out a $40,000 loan and a $15,000 loan. My friends, that is an economic benefit, not a small piece.

Financial Literacy Question

You can give a child a million dollars, but if they don’t understand how to handle it, they’ll be broke in three years. This initiative should be combined with mandatory, comprehensive financial education included in K-12 schools. Investment is a vehicle; Literacy is fuel.

My personal understanding: The power of intentionality

In my 20s, when I was running behind debt and trying to figure out how to create any kind of safety net, I felt like there was an urgent need for money everywhere. Every small crisis seemed like a disaster.

The funding the Dells are providing isn’t just money; It is intentional. It says to 25 million children: Someone has invested in your future even before you take your first breath.

That psychological message is invaluable.

It makes the American dream less about a lottery ticket and more about a pre-paid option. It’s a quiet declaration that your background shouldn’t completely determine your destiny.

The Long Tail of Impact & The Dell Legacy

This donation reflects Dell’s systems thinking. Instead of giving out 25 million one-time scholarships, they are correcting an underlying system flaw: the lack of start-up capital for non-wealthy people. They are cutting out the middleman (debt) and creating a direct path to wealth ownership using the same market forces that made their fortunes.

Dr. Lena Chavez noted, “The real impact of the Dell donation is not the $6.25 billion. It’s the potential for wealth contagion. When a child has a dedicated savings vehicle, parents are 1.5 times more likely to open their own retirement account. The Dell initiative has the scale to prove this nationally, pulling millions of families into the formal financial system.”

It’s a real domino effect. It doesn’t just benefit the child; It introduces basic financial literacy and hope to the entire family.

Practical next steps for parents

If you are reading this and wondering how this affects your family, here is some real, practical advice.

1. Identify eligibility and register immediately

The funding is very targeted. Don’t assume you know the revenue cut. When the official registration portal is released, likely in partnership with state health departments and local schools, you need to check immediately. Expect registration to be streamlined through existing infrastructure: newborn registration at hospitals or WIC/Medicaid offices.

2. Maximize matching opportunities

The true talent is in the match. Treat matching contributions as money received.

- Create a micro-savings strategy: Can you save $5 a week? When matched, those modest contributions work dramatically better, leaving just the seed money alone.

- Automatic: If possible, set up automatic transfers from your checking account to Trump Account funds. You won’t miss what you don’t see.

3. Talk About It (The Financial Education)

If your child doesn’t understand its power, that account is useless.

- Show growth: Occasionally show them the account dashboard. Let them watch the numbers increase without doing anything. This is the best, most insider lesson in compound interest you can give.

- Discuss restrictions: Be clear about what the money is for (college, house, business) and what it is not for (new gaming console). This teaches delayed gratification and goal setting.

Final Thoughts: A Generational Condition

Michael and Susan Dell aren’t just donating $6.25 billion; They are placing a big bet on America’s next generation. They are betting that the availability of capital, along with financial literacy, can fundamentally break the cycle of poverty and low wealth accumulation.

This is a quiet revolution funded by very hefty checks. And I, for one, am eager to see the world created by those children who have grown up knowing that they have an asset, a piece of capital, waiting for them at the finish line.