A Beginner’s Guide to Creating a Budget That Really Works: Release Stress and Start Prospering

If the word “budget” immediately makes you think of cutting expenses, suffering in silence, or writing figures in a spreadsheet until your eyes sting, you’re not alone. Most of us grew up believing that budgeting is basically financial punishment – something responsible adults do and forgoes everything that makes life fun.

But here’s the truth that no one really says out loud:

A good budget is not a restriction. It’s the opposite – it’s freedom.

That is clarity.

That is confidence.

He wakes up one day and realizes that his money finally listens to him.

Think of budgeting like using Google Maps. If you place a pin at your location and tell it where you want to go, it guides you. But what if you don’t provide any information? You’ll keep driving in circles and burning out, wondering why you’re not getting anywhere.

This guide is the version I wish someone had handed me years ago – simple, forgiving, and realistic. No offense. No load. A clear way to take control of your money without feeling like you signed up for a financial bootcamp.

1. Before anything else: Let’s improve the budgeting mindset

Most people fail at budgeting because people fail at dieting:

They try to eliminate everything fun… all at once… forever.

It works for a few days. Maybe a few weeks if you’re very stubborn.

Then? Boom – I’m so happy. Maybe it’s a shopping spree. Maybe it’s food delivery five nights in a row. No matter how much it costs, guilt immediately sets in.

And then we give up.

Not because we are bad with money.

Not because we are irresponsible.

But because we treat the budget as a punishment rather than a plan.

A sustainable budget is built around what you truly value.

If you really love your morning latte, why would you cut it out? Why torture yourself over $4 when you really want next year’s trip or a paid-off credit card?

Budgeting is not about eliminating joy.

It’s about deciding which pleasures you want the most.

Ask yourself a simple question (seriously, stop and think):

“What do I want my money to do for me this year?”

A budget becomes meaningful the moment it is connected to your cherished goal.

2. Step One: Know where you are starting from (your financial reality check)

Before we talk about methods and systems, we need data – and not scary spreadsheet data. Just clarity.

Most people think they know where their money goes.

But when do they actually track it?

They are shocked. Sometimes it’s scary. Usually feels ashamed. (Don’t worry – this is universal.)

Here’s how to get a realistic picture:

Step 1: What is your actual take-home income?

I’m talking about the money that actually goes into your bank account — after taxes, insurance, retirement contributions, and that mysterious “other deductions” line that you never fully understand.

Add side hustles, commissions, freelance gigs — whatever is relevant.

Your goal:

A simple number: your monthly usable income.

Step 2: Track your spending for 30 days

This part is strangely eye-opening.

For the next month, just observe. Don’t judge.

Record every rupee/dollar that leaves your account.

Choose a method that doesn’t bother you:

- Use an app like YNAB, Mint, or EveryDollar

- Download your bank/credit card statements

- Or keep a simple notes app list

And here’s the funny thing: When people do this, the same four trouble areas appear every time:

General Budget Leak:

- You forgot you had subscriptions

- Random eating out (coffee, snacks, fast food, you name it)

- Grocery overspending (we’ve all bought snacks we didn’t need)

- Impulse shopping (hello, Amazon at 1 a.m.)

The goal is not perfection. It is awareness.

Once you know the numbers, budgeting becomes ten times easier.

3. Step Two: Choose a budgeting method that suits you

This is where people get stuck – they choose the method that works for their coworker, cousin, or influencer, instead of the method that works for their personality.

Let’s break down the three realistic approaches.

Method A: The low-stress 50/30/20 rule

Perfect for beginners or those who don’t want to micromanage every penny.

Here’s how it works:

- 50% → Needs

(Rent, Groceries, Utilities, Insurance, Transportation) - 30% → Wants

(Dining out, hobbies, fun things) - 20% → Savings and Debt

(Emergency fund, investments, paying off additional debt)

No complicated categories. No stress.

If you want a simple system that still delivers results – this is the best option for you.

Method B: Zero-Based Budgeting (ZBB)

This is for the organized mind. For the planners. For the people who really enjoy customizing their Notion pages.

Your rule:

Every dollar creates a job.

If you bring in $5,000, you allot $5,000 – whether it’s groceries, bills, savings or a “future vacation” fund.

It’s detailed, but incredibly effective at eliminating the “Where did my money go?” problem.

Apps like YNAB are designed for exactly this.

Method C: Envelope System (Old School but Brilliant)

If you overspend – especially on groceries, shopping, or social events – this can be your best friend.

Here’s how it works:

- Withdraw cash for specific categories

- Put them in envelopes

- Spend only what’s inside

When the envelope is empty, that series is complete for the month.

There are also digital versions, but the physical envelope works differently – in a good way.

4. Step Three: Build your financial safety net

Before aggressively paying off loans or making heavy investments, you need a buffer between you and life’s inevitable surprises.

Your first priority: Emergency fund

Tier 1: Mini Fund ($1,000–$2,500)

This covers annoying but manageable emergencies:

- Flat Tire

- Dental Problems

- Small Medical Bills

- Unexpected Travel

- Pet Emergencies

You’d be surprised how much anxiety goes away after this comes into existence.

Tier 2: Full emergency fund (3-6 months of expenses)

This is your stability fund – it protects you if you lose your job or income.

And no, it won’t happen overnight. It will take time.

Where to keep it

High-Yield Savings Account (HYSA).

Not in checking. Not in crypto. Not under your mattress.

Manage the expenses you always forget

You know the ones…

- Holiday Gifts

- Car Repair

- Insurance Premiums

- Pet Care

- Annual Memberships

Every year they always come, yet we are still surprised.

Enter: sinking funds.

If your annual car insurance is $1,200, save just $100 each month in the “car insurance” category.

When does the bill arrive? Don’t panic. No fuss. No need to swipe a credit card.

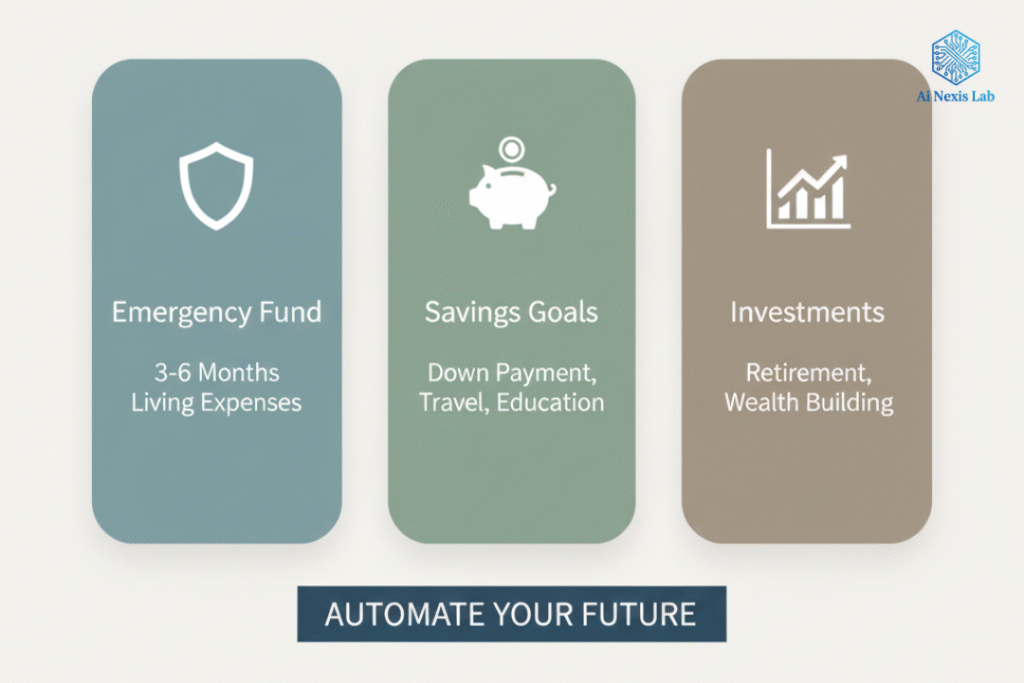

5. Step 4: Automate boring content, review important content

Let’s be honest: The more manual your budget system is, the faster you’ll abandon it.

Automate everything you can.

- Automate savings

- Automate bill payments

- Automate recurring transfers to sinking funds

- Use bank rules to categorize transactions

Think of automation as a silent assistant managing your financial life behind the scenes.

Weekly check-in (15 minutes)

A brief moment of “Why are we here?” Make adjustments if needed. No guilt.

Monthly reset (30 minutes)

What worked? What went wrong? Which category needs to be changed?

Quarterly Review

Bigger-picture stuff:

- Are your needs becoming too expensive?

- Is your income increasing?

- Should you rebalance categories?

And please – be kind to yourself. Budgeting is messy.

Even the most disciplined people sometimes overspend.

It’s data, not failure.

6. Your simple action plan (recap)

Here is the tour in a short table:

| Phase | Goal | What You Do |

|---|---|---|

| Mindset | Prioritize fun, not restrictions | Identify your top money goals |

| Reality check | Know your numbers | Track income + expenses for 30 days |

| Choose a method | Choose your style | 50/30/20, ZBB, or Envelopes |

| Build a foundation | Protect your future | Emergency fund + Protect sinking funds |

| Sustain | Stay consistent | Automate + weekly/monthly reviews |

Budgeting is a skill – and like any skill, it improves with practice.

Don’t wait for “next month” or “when things settle down.”

Start with what you have today.

Your future will be very grateful.