Payroll Cuts What the 2026 Student Loan Garnishment Shift Really Means for You

For years, federal student loan borrowers have been living in a strange kind of financial uncertainty. Payments were paused. Collections softened. Results were delayed. If you were in default, it often felt like the system had quietly backed down, leaving you suspended somewhere between relief and uncertainty.

That suspension is coming to an end.

According to detailed reporting by The Washington Post, Newsweek and multiple regional outlets, the U.S. Department of Education has confirmed a major policy change:

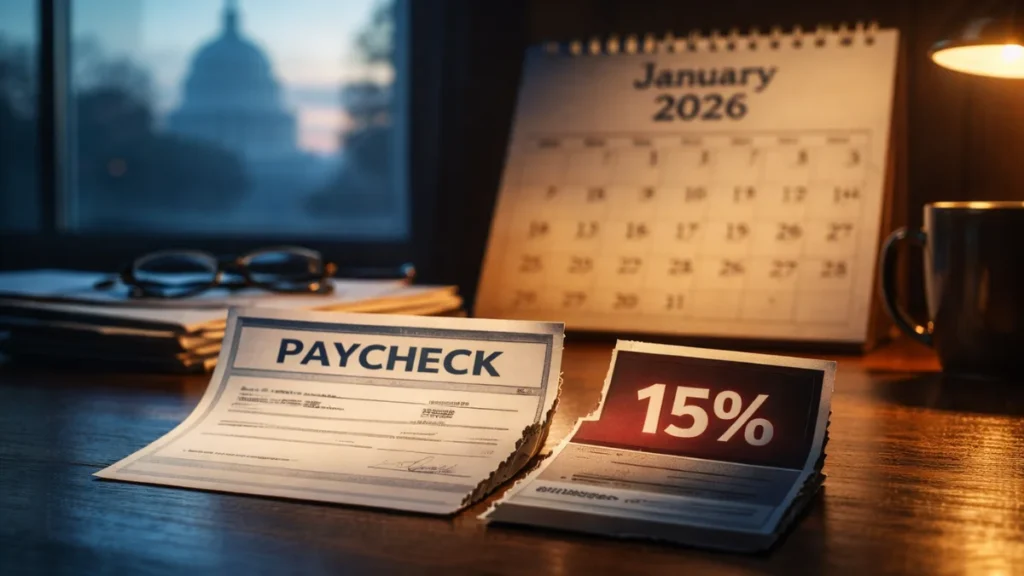

Starting January 2026, administrative wage garnishments for defaulted federal student loans will resume.

The decision, supported by the Trump administration, affects an estimated 5.3 million borrowers. For those individuals, up to 15% of their disposable income could be taken directly from their paychecks – without a court order.

This is not a theoretical policy change. It has a direct impact on household cash flow, and for many families, it could reshape daily life.

Below is a clear, human-first analysis of what’s happening, why it’s happening now, who’s most at risk, and – most importantly – what you can do before January 2026 arrives.

A long pause comes at a difficult break

To understand why this moment seems so sudden, you have to think again.

When the COVID-19 pandemic hit, federal student loan collections effectively froze. Payments stopped. Interest was set to zero. Wage garnishments and tax refund seizures were halted. For borrowers already in default, the pause wasn’t just helpful — it was life-changing.

Over time, that crisis response grew into something longer and more complex:

- Multiple extensions in administration

- Temporary “on-ramp” protections

- Fresh Start initiatives, designed to get borrowers out of default without penalties

For nearly five years, the harshest collection tools remained in place.

But that window is closing.

The current administration has framed the resumption of garnishments as a “return to financial normalcy”. From a budgetary standpoint, officials argue that indefinitely postponing collections on billions of dollars of federal debt is not sustainable.

From a household perspective, however, this doesn’t seem like a normal thing at all. It comes as a shock — especially to borrowers who had assumed the moratorium would quietly become permanent.

Why is wage garnishment so different (and so dangerous)?

When most people think of debt collection, they picture lawsuits, courtrooms, or nonstop calls from collection agencies.

Federal student loans operate under a different rulebook.

Administrative Wage Garnishment (AWG), Explained

Administrative wage garnishment allows the federal government to take money directly from your paycheck without going to court.

If you are in default – generally defined as 270 days or more without payment – the Department of Education can:

- Send you a notice of intent to garnish

- Notify your employer

- Ask your employer to withhold up to 15% of your disposable pay

- Apply those funds directly to your student loan balance

Your employer is legally required to comply. Refusal can result in fines.

This is why the AWG is so powerful – and so disruptive. A judge cannot assess the circumstances unless you push the issue by requesting a hearing.

Impact Scale: 5.3 Million Real-Life

The number is staggering: 5.3 million borrowers.

But behind those figures are people from every profession:

- Teachers and school staff

- Healthcare workers and aides

- Casual workers and warehouse workers

- Older workers with partial W-2 income

- Parents matching rent, child care, and medical bills

This is not a huge amount. They are the backbone of the workforce.

The 15% Rule in Real Terms

Let’s translate the principle into everyday math.

If your disposable income (after legally required deductions) is:

- ₹3,000/month → ₹450 garnished

- ₹4,000/month → ₹600 garnished

- ₹5,000/month → ₹750 garnished

For already struggling families, even a loss of ₹400 per month can lead to a number of consequences: missing rent, credit card reliance, delayed medical care, or falling behind on utilities.

This is why many advocacy groups are warning that wage garnishment not only creates debt – it makes lives unstable.

Why is January 2026 so important?

January 2026 is not just a date. It’s a deadline.

It officially ends:

- Pandemic-era protections

- On-ramp leniency periods

- Broad tolerance for long-term non-payment

After that point, defaulted loans enter full enforcement mode again.

The administration’s stance is straightforward: Borrowers have time to prepare.

Critics counter that the communication is inconsistent, fragmented among servicers, and easy to miss — especially for people who have relocated, changed jobs, or been disconnected from the loan portal due to stress or confusion.

Both things can be true at the same time. And regardless of where you land politically, the consequences will come financially.

How to Know If You’re in a Risk Zone

Not everyone with student loans will face garnishment. This policy specifically targets defaulted federal loans.

Here’s how to check your risk level.

1. Log in to StudentAid.gov

This is the central source of truth for federal student loans.

If your loan status shows:

- “In Default” → You are at risk

- “In Payment”, “Forbearance”, or “Deferred” → Garnishment does not apply

If you haven’t logged in in years, do it now. Avoiding the portal will not avoid the consequences.

2. Pay attention to physical mail

By law, the Department of Education must send notice at least 30 days before garnishment begins.

That notice explains:

- Purpose of garnishment

- Percentage to be taken

- Your right to request a hearing

But here’s the key point:

If the notice goes to the old address and you never see it, the garnishment can still continue.

3. Update your contact information

If you’ve moved, changed emails, or changed employers in the past few years, update everything immediately.

Silence does not equal safety.

Your Rights: You Are Not Powerless

This is the most important section of the entire article.

Even though the garnishment has resumed, you still have rights. You still have options. But they need to be taken care of.

1. Fresh Start (if still available)

The Fresh Start initiative was designed to get borrowers out of default and reset their status to “in good standing.”

If you are eligible and enroll:

- Your default is removed

- Things close

- Garnishment cannot proceed

Eligibility rules may evolve as 2026 approaches, so check promptly.

2. Request a Garnishment Hearing

Once you receive a notice of intent to garnish, you can request a hearing.

You can challenge a garnishment based on:

- Financial hardship

If losing 15% of your income means you can’t meet basic living expenses, the garnishment can be reduced or suspended for up to one year. - Bad debt

Mistakes. Wrong balance. Wrong borrower. Wrong loan. - Existing Payment Agreement

If you are already making payments under an approved plan, garnishment can be stopped.

The deadlines are important here. Miss them, and your options quickly shrink.

3. Loan rehabilitation

Rehabilitation requires nine affordable, consecutive monthly payments.

Once completed:

- Default is eliminated

- Garnishment stops

- Credit reporting improves

It’s slow, but it’s powerful.

4. Loan Consolidation

Consolidation replaces an old defaulted loan with a new loan in good condition.

Important Warning:

You generally cannot consolidate while wages are being actively garnished, which means it is important to take action before January 2026.

The Employer Factor No One Talks About

Wage garnishment doesn’t just affect your bank account – it affects your workplace.

Your employer will receive an official notice. Payroll will be adjusted. HR will know.

For many debtors, this feels very personal. Embarrassing. Exposing.

It is important to state this clearly:

This is not a personal failure.

This is the result of a system that issued life-changing debt to teenagers, tied repayment to unexpected income, and then paused enforcement for so long that confusion became the norm.

You are not alone. You are one of millions.

The Psychological Weight of the Paycheck Squeeze

Debt collection is not just financial—it’s emotional.

Borrowers report:

- Chronic Anxiety Checking pay stubs

- Shame interacting with HR

- Fear of job change during garnishment

- Avoidance of financial planning altogether

That mental load matters. It affects decision-making, health and long-term stability.

The most harmful myth is that ignoring the problem reduces stress. In fact, uncertainty is more stressful than clarity.

What to Do Right Now (A Practical Checklist)

If you think you may be affected, don’t wait.

Step 1: Identify who holds your loans

Is it directly with the Department of Education or a collection agency working on its behalf?

Step 2: Calculate your disposable income

Find out what 15% really means for your family.

Step 3: Explore Voluntary Payments

Voluntary agreements often result in lower monthly payments than mandatory garnishments – and keep your employer out of it.

Step 4: Get professional help if needed

A student loan attorney or financial advisor who specializes in federal debt can often uncover options you didn’t know existed.

Why This Moment Matters More Than It Looks

This isn’t just about student loans.

It’s about how policy decisions spill over into kitchens, classrooms, hospitals, and break rooms. It’s about whether recovery means returning to – or rethinking – systems that have failed.

January 2026 is fast approaching. But it’s not here yet.

That gap — now and then — is yours to exploit.

Final Thoughts: Knowledge is still power

The resumption of wage garnishment is a harsh reality. It will squeeze paychecks. It will force tough conversations. It will test the resilience of households.

But that doesn’t eliminate your agency.

You still have time to:

- Check your status

- Fix errors

- Enroll in programs

- Reduce or stop garnishments completely

Don’t wait for your first small paycheck to figure out what’s going on.

Face the numbers. Use options. Protect your income.

Because once garnishments begin, the costs of inaction become painfully apparent – and painfully so on a monthly basis.

Frequently Asked Questions (FAQ)

Q1: When exactly will student loan wage garnishment restart?

Wage garnishment for defaulted federal student loans is scheduled to resume in January 2026. At that time, current forbearance and on-ramp protections officially end, and full collection tools – including administrative wage garnishment – come back into effect.

Q2: Who is most at risk of having wages garnished?

The only borrowers at risk are those who are in default on their federal student loans. Default generally means that you have not made a required payment for 270 days or more. If your loan is in payment, deferment, forbearance, or any active payment plan, wage garnishment does not apply.

Q3: How much of my paycheck can be taken?

The government can provide up to 15% of your disposable income. Disposable pay is the salary left over after legally required deductions like taxes and Social Security – not the amount that comes into your bank account after rent, food, or bills.

Q4: Can the government increase my salary without going to court?

Yes. Federal student loans are subject to special rules. The government does not need a court order to garnish wages. This is called administrative wage garnishment, and employers are legally required to comply with it.

Q5: Will my employer know about my student loan default?

Yes. If garnishment is initiated, your employer will receive formal notice and will have to adjust the payroll accordingly. HR or payroll staff will be knowledgeable, which is why many debtors try to resolve the problem before garnishment begins.

Q6: What if I never receive a garnishment notice?

The Department of Education is required to send notice at least 30 days before the garnishment begins, but even if it goes to the old address or email, the garnishment can still continue. That’s why it’s important to update your contact information.

Q7: Is there a way to stop wage garnishment before it starts?

Yes. Common options include:

1) Getting out of default through Fresh Start (if still available)

2) Entering loan rehabilitation

3) Consolidating the defaulted loan (before garnishment begins)

4) Establishing a voluntary payment agreement

Taking action before January 2026 gives you much more flexibility.

Q8: Can I stop or reduce the garnishment once it starts?

In some cases, yes. You can request a garnishment hearing and challenge it based on:

1) Financial hardship

2) Incorrect loan balance or identification errors

3) Existing payment agreement

If approved, the garnishment may be reduced or temporarily suspended.

Q9: Does wage garnishment apply to private student loans?

No. This policy only applies to federal student loans. Private lenders have to go through court and follow various legal procedures to get paid.

Q10: Will wage garnishment affect my credit score?

Default already damages your credit, but getting out of default through rehabilitation or consolidation can help improve it over time. Garnishment itself doesn’t directly lower your score – but staying in default does.