The Great AI Reckoning: 7 Shocking Reasons Oracle Became the AI Bubble Warning

Why Oracle Became the Face of Growing AI Bubble Fears

For most of its life, the Oracle remained boring at best.

It was a company that ran payroll systems, bank ledgers, airline reservations, and government databases. Oracle wasn’t chasing hype. It sold credibility. And that reliability made Larry Ellison’s creation one of the most profitable enterprise software machines in history.

But the AI boom changed the rules of the game.

Suddenly, boring wasn’t good enough. The tech world changed from a software margin to a silicon arms race. From cloud abstraction to concrete, steel, land, power and debt. And while trying to make the leap from trusted legacy giant to AI-era infrastructure king, Oracle found itself walking a very thin line.

Today, Oracle is not just another AI participant. It has become something more symbolic: a stress test for the entire AI economy.

When a massive AI-focused debt deal collapsed, when Michael Burry started touring the sector, and when real-world data center projects stalled in places like Saline, Michigan, the story came into focus.

This is not just about Oracle anymore.

It’s about whether the current AI buildout is economically viable.

Table of Contents

Oracle’s identity crisis: From databases to data centers

For decades, Oracle’s business model was very simple:

- Sell expensive, mission-critical database licenses

- Lock in customers for years

- Generate massive recurring cash flow

- Spend relatively little on physical infrastructure

That model made Oracle very profitable. When the cloud era arrived, it was also slow to adapt.

While Microsoft, Google, and Amazon were pouring money into hyperscale cloud infrastructure, Oracle was hesitant. For a long time, Alison dismissed Cloud as a fad.

Then reality set in.

Enterprise customers began moving workloads from on-premises servers. New startups completely abandoned Oracle. Cloud-native databases have taken away Oracle’s dominance.

Oracle needed another job.

AI became a task.

The Big bet: OCI as the AI backbone

Oracle’s answer to being late to the cloud was bold: skip the general-purpose cloud competition and go straight to high-performance AI infrastructure.

Oracle Cloud Infrastructure (OCI) was positioned as:

- Faster than competitors

- Affordable for GPU-heavy workloads

- Specifically optimized for large-scale AI training and inference

Allison leaned toward a simple message: “If you’re building big AI models, OCI is where you want to be.”

The strategy was not entirely irrational.

AI workloads behave differently from traditional cloud workloads. They demand:

- Large GPU clusters

- Ultra-fast networking

- Predictable performance

- Large, upfront capital investment

Oracle claimed it could deliver all of this more efficiently than incumbents.

And for a while, investors liked the story.

Oracle shares surge as market seeks “AI exposure” beyond chipmakers. OCI became a narrative bridge between legacy enterprise software and the AI future.

But behind the optimism lay a cruel truth.

AI is not software economics – it is industrial economics

This is where many investors underestimate the risk.

Traditional enterprise software scales beautifully:

- Build once

- Sell indefinitely

- Margins expand over time

AI infrastructure scales like a product:

- Each new customer requires physical capacity

- GPUs must be purchased upfront

- Data centers must be built before revenue comes in

- Power, cooling, land, and networking costs never stop

To support AI at scale, Oracle had to transform itself into something closer to a utility company than a software vendor.

That transformation has been capital-hungry.

And capital was no longer cheap.

The debt deal that changed the conversation

The turning point came when Oracle failed to complete a large AI-related debt financing deal.

This was no small setback. It was a signal.

Debt markets exist to price risk. When lenders hesitate, it’s because their models no longer add up.

For Oracle, the failure raised uncomfortable questions:

- Will AI workloads generate revenue quickly enough?

- Are GPU-based cloud margins sustainable?

- What happens if demand softens after the hype phase?

- How much risk is Oracle at to rising interest rates?

Oracle didn’t just need capital for growth.

It needed capital to keep it going.

When securing that capital suddenly seemed difficult, the tone on Wall Street changed almost overnight.

The question is no longer “How big can OCI get?”

It became “What happens if this doesn’t pay?”

Michael Bury’s example: When suspects smell blood

Every time the markets shake, Michael Bury reappears in the headlines like a storm warning.

Bury is not famous because he is always right.

It is famous because when it is true, the consequences are enormous.

Their new bearish stance on AI-heavy tech stocks after Oracle’s financing struggles added fuel to the fire.

Bury’s worldview is simple:

- Hype inflates valuations

- Capital spending ultimately matters

- Cash flow always wins

From his perspective, today’s AI boom looks eerily familiar. Huge spending by future income that has not yet appeared. Evaluation based on stories rather than earnings.

Oracle, with its aggressive AI pivot and visible financing challenges, became an easy target.

Even investors who disagreed with Bury had to ask themselves a dangerous question:

What if he’s early… not wrong?

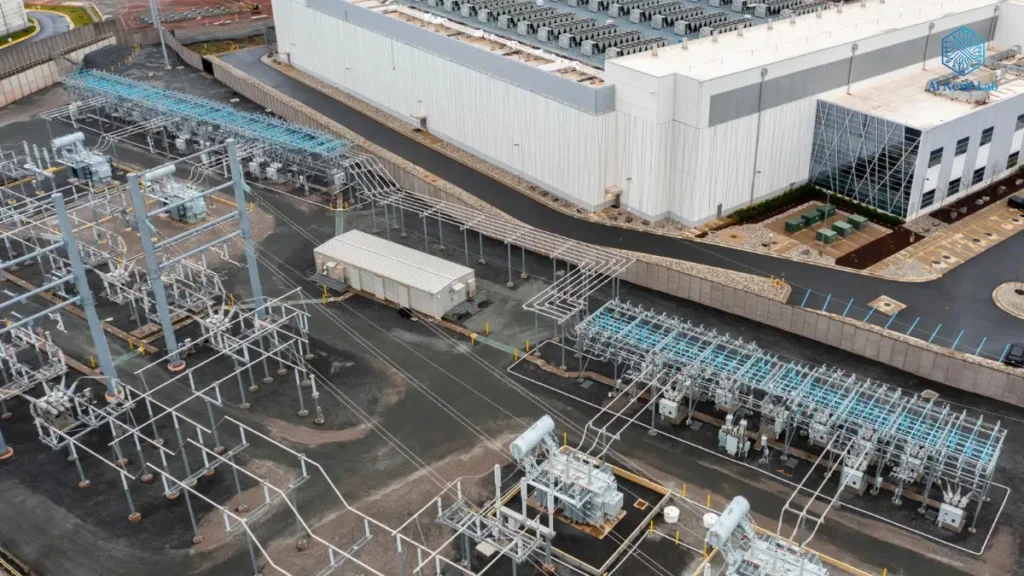

The Ground Truth: Saline, Michigan, and the Limits of AI Expansion

Wall Street talks in spreadsheets.

Reality shows up in zoning meetings.

The stalled data center project in Saline, Michigan, seems like a small, local story. It’s not.

It’s a snapshot of an AI economy pushing physical limits.

Why projects like Saline are stalling:

1. Power constraints

AI data centers consume a staggering amount of electricity. Local grids were often not designed for this scale. Upgrading them is expensive, slow, and politically sensitive.

2. Financing pressure

As interest rates remain high, the math on long-term infrastructure investments becomes more difficult. The returns must be clear. The risks must be low.

3. Community resistance

Residents are asking reasonable questions:

- Where are the jobs?

- Why does this facility need so much water?

- What happens to property values?

- Who pays for the grid upgrades?

4. Long payback periods

Unlike factories that employ thousands of people, data centers create relatively few permanent jobs. The economic benefits are indirect and long-term.

When these local projects stall, they expose the fragility of national AI buildouts. You can’t scale AI in theory if you can’t make it in practice.

Why Oracle Took the Heat (Instead of NVIDIA or Microsoft)

It’s tempting to ask why Oracle became a symbol of the fear of the AI bubble while others escaped scrutiny?

The answer is leverage and positioning.

NVIDIA

NVIDIA sells picks and shovels. Once the GPU is sold, the risk is transferred to the buyer. NVIDIA gets paid regardless of whether the AI models ever make money.

Microsoft

Microsoft can be patient. Office, Windows, Azure, and Enterprise licensing generate enormous stable cash flow. AI losses can be absorbed.

Oracle

Oracle sits in a dangerous zone:

- At the end of the cloud

- Aggressively repositioning around AI

- Heavy infrastructure costs

- Less diverse growth engine

Oracle needed AI to work faster. Not finally. Fast.

That urgency increased the risk.

The AI revenue gap that no one likes to talk about

Here’s the uncomfortable reality at the heart of the AI debate:

AI spending has expanded faster than AI revenue.

Yes, AI tools are impressive. Yes, productivity gains are real. But when investors look at the concrete numbers, the difference is clear.

Companies are spending:

- Billions on GPUs

- Billions on data centers

- Billions on power and cooling

But how much additional revenue is AI generating today?

- Chatbots save money by replacing support agents, but don’t always generate new revenue

- AI assistants improve workflow, but pricing power is limited

- Many enterprise AI features are bundled, not billed separately

This creates a time problem.

CapEx is immediate.

Revenue is uncertain and delayed.

This gap was brought into focus by Oracle’s financial stumble.

Environmental Reality: The Hidden Cost of “The Cloud”

Another reason Oracle’s story resonates is the growing awareness of the environmental impact of AI.

AI data centers are:

- Energy intensive

- Water intensive

- Heat generating

- Land hungry

As communities realize that the “cloud” is actually a huge industrial facility nearby, resistance grows.

Regulators are taking notice. Environmental impact assessments are slowing down projects. Utility negotiations are becoming more difficult.

These costs were not entirely worth the initial AI optimism.

They are now.

Is this the end of AI? Not even close.

This is not the death of AI.

This is the end of unbridled AI exuberance.

Every major technology wave goes through these phases:

- Railroads

- Electricity

- Internet

- Mobile

- Cloud

Photovoltaics doesn’t kill technology.

It kills unrealistic expectations.

AI will completely reshape industries. But the winners won’t be the companies that spend the fastest. They’ll be the companies that:

- Match infrastructure development with real demand

- Generate clear, recurring revenue

- Manage capital efficiently

- Work with communities instead of bulldozing them

What Oracle must prove next

If Oracle wants to escape its “poster child” status, it needs to demonstrate three things convincingly:

1. Financial discipline

Not every AI dollar today needs to be used. Sustainable growth beats flashy expansion.

2. Real Customer Value

OCI should win workloads because it is actually better or cheaper – not because of hype.

3. Enterprise AI Monetization

Oracle’s legacy database dominance could become its secret weapon if AI features translate into measurable ROI for customers.

If Oracle accomplishes this, today’s panic will seem overblown.

If it doesn’t happen, the warning story will go down in history.

Final thoughts: AI computing is about reality, not fear

Oracle didn’t become the face of AI bubble fears because it failed.

It became the face because it tried.

It tried to leapfrog from legacy software giant to AI infrastructure powerhouse in the most capital-intensive tech cycle in decades.

The coming years will separate the builders from the dreamers.

The future of AI won’t belong to the biggest evangelists or the biggest spenders. It will belong to companies that respect physics, money, and patience.

And for investors, the lesson is simple:

Watch the power lines.

Watch the balance sheets.

Watch the debt.

That’s where the real AI story is unfolding.

Frequently Asked Questions (FAQ)

Q1: Is Oracle actually in financial trouble?

No, Oracle is not in immediate danger. It is still very profitable. The concern is about future risk, not current collapse.

Q2: Does Oracle’s debt issue mean the AI bubble is bursting?

Not necessarily. It suggests a redefinition of risk, not the end of AI adoption.

Q3: Why are data centers becoming controversial?

Because they consume large amounts of electricity and water while providing limited local employment.

Q4: Is Michael Bury always right?

No. But their skepticism often highlights real structural risks that markets ignore during hype cycles.

Q5: Should investors avoid AI stocks?

It’s not straightforward. But selection is more important now. Fundamentals, cash flow and capital discipline are becoming more important.

Q6: Will AI infrastructure spending slow down?

Maybe yes – but slowing down doesn’t mean it stops. Growth can become more measured and rational.

Q7: What is the biggest threat to Oracle?

Overbuilding of infrastructure faster than demand can be met.

Q8: Can Oracle still win in AI?

Yes, if it aligns costs with revenues and uses its enterprise relationships effectively.