USAC’s $860 Million J-W Power Deal: A Powerful Boost to U.S. Natural Gas Compression Industry – What Does That Mean?

The acquisition of J-W Power Company by USA Compression Partners for $860 million is one of the largest and most strategic moves in the natural gas compression industry. The deal significantly expands USAC’s power, strengthens its presence in major U.S. basins, and paves the way for rapid growth as the industry prepares for 2026 and beyond.

In a major move that is already shaking up the U.S. mid-stream natural gas compression landscape, USA Compression Partners, LP (USAC) recently confirmed its plans to acquire J-W Power Company, one of the nation’s largest private compression service providers. This transaction, valued at approximately US$860 million, is more than just a high-profile announcement. It has serious implications for how compression capacity is deployed, optimized, and scaled in major shale regions from the Permian Basin to the Rockies.

The acquisition is expected to expand USAC’s operational footprint, increase service capabilities and reshape competition in an industry where scale, reliability and horsepower availability increasingly define success. As demand for natural gas in the lower 48 states continues to grow due to LNG exports, power generation, and industrial use, the ability to provide large-horsepower compression solutions is becoming more important than ever.

What is really happening? — Deal details at a glance

- Purchase price: US$ 860 million. It will consist of US$430 million in cash and approximately 18.3 million new USAC common units (valued at approximately US$430 million) issued to the seller.

- Final timeline: The transaction is expected to close in the first quarter of 2026, subject to customary regulatory approvals and closing conditions.

- Post-deal scale: The combined fleet will have about 4.4 million active horsepower – a big jump from USAC’s independent capacity.

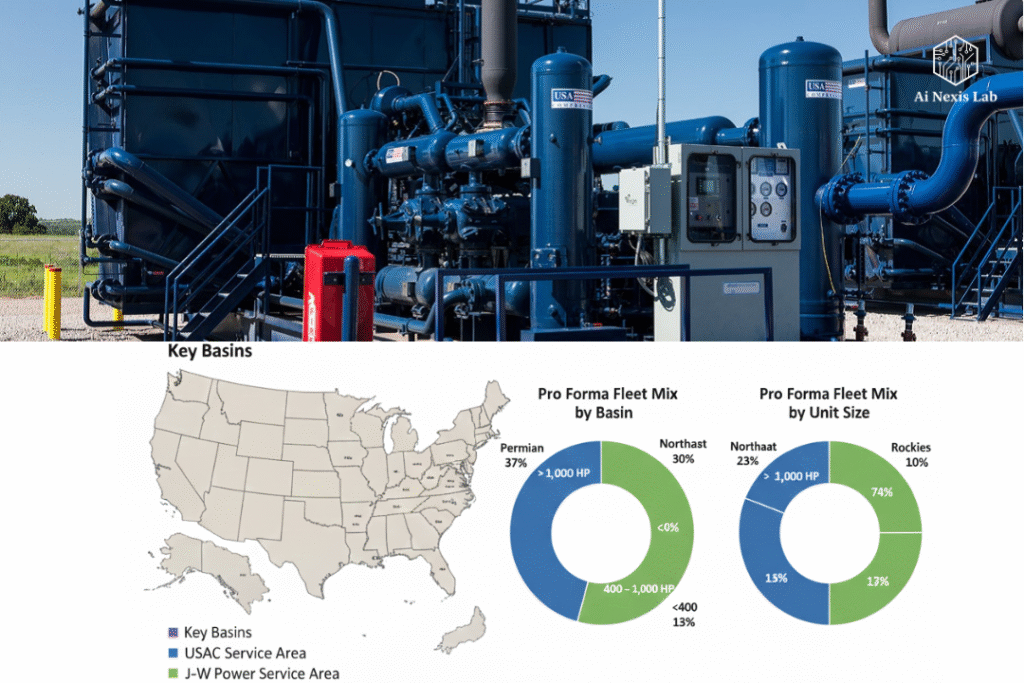

- Expanded footprint: This acquisition brings more than 0.8 million additional horsepower to key natural-gas and oil-producing regions in the U.S. – including the Northeast, Mid-Continent, Rockies, Gulf Coast, Bakken and Permian Basins.

- Business diversification: In addition to compression horsepower, the deal includes J-W Power’s aftermarket services, parts-distribution operations and specialized manufacturing capabilities for compression packages – expanding USAC’s service offerings.

In short: USAC is adding a significant chunk of horsepower, expanding its service portfolio, and broadening its geographic reach – a sweeping expansion.

Why does this acquisition make strategic sense for USA Compression?

1. Massive scale and horsepower expansion

With a total of ~4.4 million horsepower under management following this transaction, USAC solidifies its position as the leading compression-services provider in the U.S. This scale gives it a significant advantage when bidding for large midstream projects and growing demand across multiple basins.

2. Geographic diversification reduces basin-specific risk

USAC spreads its operational risk – adding coverage to multiple regions – from the Gulf Coast to the Rockies and the Bakken. If one basin slows down (e.g., due to regulatory pressure or production declines), operations in other areas can help buffer the impact.

3. Diverse business lines – beyond just compression horsepower

With J-W Power’s aftermarket parts, maintenance services and manufacturing capabilities, USAC is transforming into a more full-service compression-services operator. It offers not only project-based revenue, but recurring revenue potential (parts + maintenance demand) – which can smooth out revenue throughout the cycle.

4. Financial benefits: Increased cash flow and better valuation metrics

The deal is expected to be accretive on a distributable cash flow (DCF) basis – meaning that, once closed, additional cash flow from J-W Power will help support or even increase distributions to unitholders.

Additionally, USAC holds a valuation at ~5.8× estimated 2026 adjusted EBITDA – a relatively attractive multiple before any synergies.

Finally, USAC expects to move to leverage (debt/EBITDA) below 4.0×, improving its balance sheet strength.

5. Strong demand backdrop for natural gas compression

With continued production in major U.S. shale basins, demand for compressor services remains strong. This acquisition positions USAC to capture a greater share of that demand, particularly for larger horsepower units and specialized compression jobs.

Potential challenges and risks – what could go wrong?

Not everything is easy. This acquisition comes with a set of risks and open questions.

- Leverage and debt risk: While the plan is to deleverage below 4× net debt/EBITDA, consolidating the acquisition value (cash + equity) of approximately US$ 860 million adds complexity. If natural gas demand or compression usage declines, debt servicing could become more difficult.

- Integration risk: Merging fleets, maintenance operations, production and workforces – especially from a company with a 60-year heritage like J-W Power – brings potential cultural, operational and logistical challenges.

- Cyclicality, commodity-price dependency: USAC’s revenue is tied to upstream oil and gas activity. A slowdown in drilling or production (due to low commodity prices or regulatory changes) can hurt compressor demand – which can reduce utilization rates and cash flow.

- Execution risk on synergies: Promised benefits (cost savings, cross-servicing, efficiency improvements) depend on how well USAC integrates J-W Power’s operations. Delays or mismanagement can reduce expected payments.

- Regulatory and environmental concerns: Natural-gas compression and midstream infrastructure facilities are under regulatory scrutiny. Any regulatory constraints or environmental restrictions in the main basin could affect operations or demand. (This is a broad area of risk, but relevant considering USAC’s expansive footprint.)

Real-world context: Why this acquisition could be a game-changer

To understand the importance of this step, let’s zoom out:

- History and Legacy Behind J-W Power: J-W Power has a 60-year track record, having built over 8,000 compressor packages and served 300+ customers in major U.S. basins. That means USAC isn’t just buying a company – it’s inheriting decades of engineering knowledge, long-standing customer relationships and a proven fleet of units.

- Wave of consolidation in midstream services: The midstream sector is seeing consolidation – as major players aim to secure capacity, reduce costs and streamline operations. This deal signals that the trend is accelerating. Companies like USAC can aim to be a one-stop shop for compression, maintenance, parts and more.

- Investor Appeal for Yield + Growth: For investors, USAC has remained attractive even amid volatility for its regular distributions (US$0.525 per common unit in the third quarter of 2025).

- J-W Power acquisitions can strengthen distributions or support future growth – combining yield with strategic expansion.

In many ways, this acquisition feels like the “next phase” – from a fleet-based compression provider to a more integrated mid-stream services powerhouse.

Frequently Asked Questions — What you (or investors) might be thinking

Q1: When will the acquisition be completed?

A: Closing is expected in the first quarter of 2026, subject to regulatory approvals and customary closing conditions.

Q2: How will USAC pay for it?

A: The deal is using US$430 million in cash – initially drawn from its revolving credit facility – plus the issuance of 18.3 million new USAC common units (equity) valued at US$430 million.

Q3: Will there be a reduction in existing unitholders?

A: Yes — the issuance of 18.3 million new units to J-W Power owners increases total units outstanding, which could reduce earnings per unit or distributions if not offset by additional cash flow and synergies.

Q3: Does this acquisition guarantee a high cash distribution?

A: No guarantees — much depends on actual integration success, utilization rates in the expanded fleet, demand for compression services, and overall commodity-market conditions.

Q4: What makes J-W Power an attractive target?

A: In addition to its large fleet and horsepower, J-W Power has decades of experience, a loyal and diverse customer base, aftermarket and parts-distribution operations, and a reputation for building compressor packages – capabilities that enhance USAC’s service offering and resilience.

What’s next – what to watch

- Closing and Regulatory Approvals — The deal still needs to clarify standard regulatory and closing conditions. Pay attention to any filings or delays.

- Integration Progress and Synergy Realization — Track how USAC is merging its fleet, maintenance/parts business, and staff — and whether anticipated savings or efficiencies are being realized.

- Utilization Rates and Demand in Key Basins — Because revenue contraction depends on demand, changes in gas production, pipeline activity, or environmental regulation could impact earnings.

- Leverage Metrics and Balance Sheet Health — With additional cash-and-equity financing, it will be important to monitor USAC’s debt-to-EBITDA ratio and interest expense, especially amid any interest-rate changes.

- Distribution Policy and Investor Returns — Will USAC increase distributions, maintain them, or prioritize debt reduction and reinvestment?

Conclusion: A bold, strategic bet on growth and scale

The $860 million acquisition of J-W Power Company has catapulted USA Compression Partners to a new level. It’s no longer just a matter of keeping compression horsepower – this deal could transform USAC into a more diversified, full-service midstream operator with a broader geographic reach, deeper service offering and a stronger competitive edge.

However, with large scale comes great responsibility: successful integration, economic cycles, commodity demand cycles, and implementation risk are all important. For investors and industry watchers, the deal will be a defining moment for USAC – one that could yield big rewards if navigated well.

If you are evaluating USAC as an investment or tracking midstream consolidation, this is a move worth following closely.